Willie Sutton, when asked by a reporter why he robbed banks, famously answered “Because that’s where the money is.” Children’s advocates should be getting involved in the growing conversation about comprehensive federal tax reform for the same reason.

Willie Sutton, when asked by a reporter why he robbed banks, famously answered “Because that’s where the money is.” Children’s advocates should be getting involved in the growing conversation about comprehensive federal tax reform for the same reason.

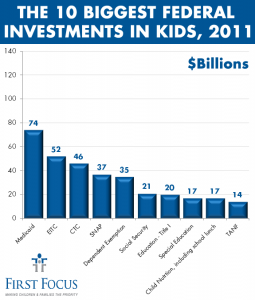

The chart at the right (from the Urban Institute’s Kids’ Share 2012 report, click for a larger version) shows the 10 biggest federal investments in kids in 2011. As you can see, Medicaid tops the list, with $74 billion invested in children’s health. Of course, CHIP is part of the mix, too, even if it doesn’t make the top-10 list. CHIP’s $8 billion only bumps the combined health coverage total to $82 billion. But take a second look at that chart – three of the top-10 are tax initiatives: the Earned Income Tax Credit (EITC), the Child Tax Credit (CTC), and the dependent exemption.

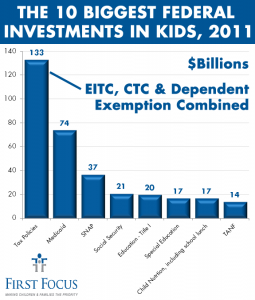

Now take a look at the chart below, which adds those three tax provisions together. With a combined investment of $133 billion, three tax policies nearly double Medicaid, making tax policy incredibly important for kids. And it’s not just about the money. The EITC and the CTC alone lift more than five million children out of poverty every year, offering a lifeline and a ladder of economic opportunity to families who most need one. And dozens more tax benefits make it more affordable for Americans of all incomes to have and care for children.

Research now indicates that the EITC and CTC ultimately do more than help parents meet their children’s basic needs, such as rent or groceries. Children who receive the EITC, for example, are healthier at birth, do better in school, are more likely to attend college, and even earn more as adults themselves. In this sense, federal investments in these important tax credits have a long-term payoff.

The tax reform conversation has already begun in Washington. The U.S. House Ways and Means Committee has created working groups to examine various aspects of federal tax law. An Education and Family Benefits working group, chaired by Tennessee Republican Diane Black and vice-chaired by Illinois Democrat Danny Davis was charged with evaluating the EITC, the CTC, and other the family tax provisions critical for kids. Their assessment and the stakeholder suggestions they received have already been published by the congressional Joint Tax Committee.

The Senate is expected to move more deliberately, as is its nature. But the announced retirement of Senate Finance Committee Chairman Max Baucus (D-MT) has fueled widespread speculation that the committee will act this year, in an effort to position comprehensive tax reform as a legacy item for the outgoing chairman. Baucus and Camp have even partnered for a tax reform “roadshow” that’s already made a Midwestern stop and is expected to continue throughout the summer.

The Senate is expected to move more deliberately, as is its nature. But the announced retirement of Senate Finance Committee Chairman Max Baucus (D-MT) has fueled widespread speculation that the committee will act this year, in an effort to position comprehensive tax reform as a legacy item for the outgoing chairman. Baucus and Camp have even partnered for a tax reform “roadshow” that’s already made a Midwestern stop and is expected to continue throughout the summer.

From a communications perspective, the problem is that, while this is a huge issue for kids, nobody’s talking about it that way. First Focus was invited to Capitol Hill tax reform forum featuring lawmakers, lobbyists, and journalists. The hot topics were philosophical ones like overall rate bracket revisions and the debate over progressivity, wonky questions like revenue neutrality mechanisms, and especially corporate tax policies like territorial taxation (don’t ask, you don’t want to know).

It’s up to us to change that. Policymakers won’t put kids on the tax reform agenda, unless we make them pay attention to children’s priorities. And it’s important that we do. As the old DC maxim goes, if you’re not at the table, you’re likely on the table.